|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

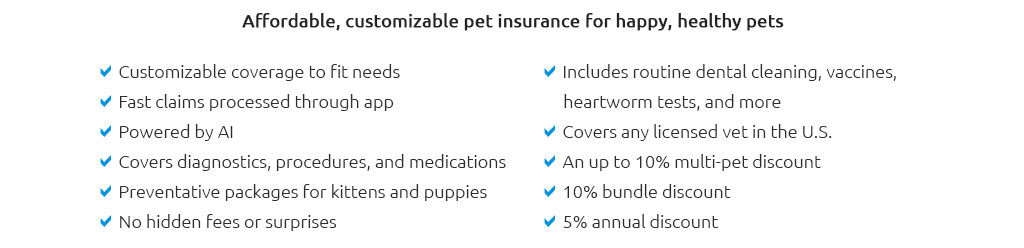

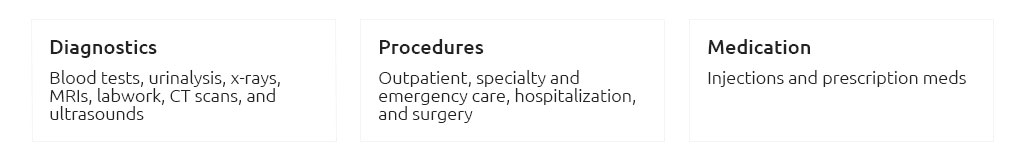

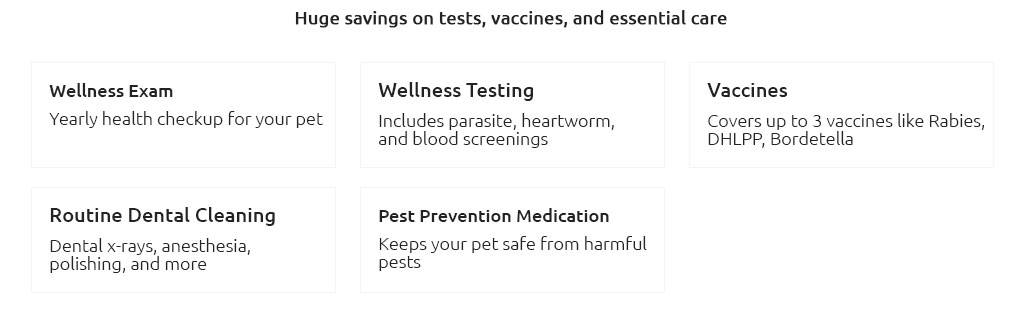

Pet Insurance Plan Comparison: An In-Depth Guide for Pet OwnersChoosing the right pet insurance plan can be a daunting task. With so many options available, it's crucial to compare plans to find the best fit for your furry friend. In this guide, we will explore various aspects of pet insurance plans, helping you make an informed decision. Understanding Pet Insurance PlansPet insurance is designed to cover veterinary costs associated with medical emergencies and routine care. Plans typically vary based on coverage, cost, and provider. Types of Coverage

Cost FactorsThe cost of pet insurance can vary significantly based on several factors, including:

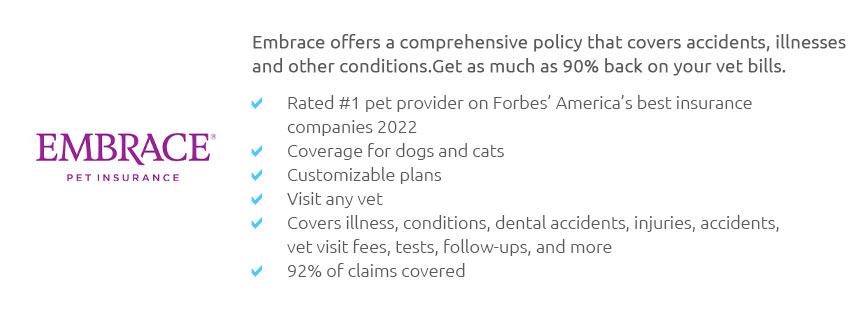

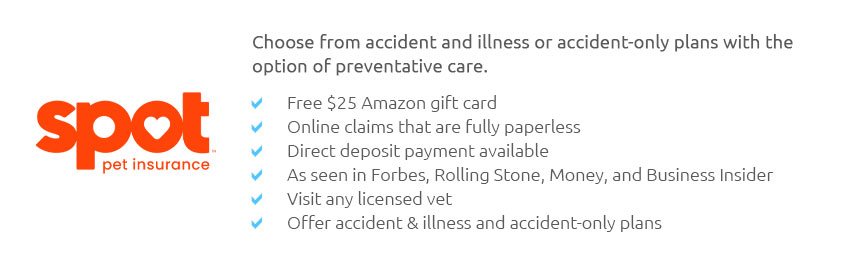

Comparing Pet Insurance ProvidersWhen comparing providers, consider their reputation, customer reviews, and the specifics of their offerings. Provider ReputationResearch the provider's reputation in the industry. Look for reviews and ratings from current and former policyholders. Policy DetailsExamine the policy details carefully. Look for exclusions, waiting periods, and coverage limits. Some providers offer pet insurance without a waiting period, which could be beneficial if immediate coverage is necessary. Making the Final DecisionAfter comparing plans, it's time to make a decision. Consider your pet's specific needs and your financial situation. Assessing Your Pet's Needs

Budget ConsiderationsChoose a plan that fits your budget while providing adequate coverage. It's essential to balance cost with the level of protection needed. For those living in specific areas, such as Wichita, there might be local considerations. Explore options like pet insurance wichita ks for region-specific plans. Frequently Asked QuestionsWhat does pet insurance typically cover?Most pet insurance plans cover accidents, illnesses, and sometimes routine care. However, coverage can vary widely between providers. Are there any exclusions I should be aware of?Yes, common exclusions include pre-existing conditions, elective procedures, and certain hereditary conditions. Always read the policy details carefully. How do I file a claim with my pet insurance provider?Typically, you will need to submit a claim form along with veterinary invoices. The process can vary, so check with your specific provider for detailed instructions. Can I get pet insurance for an older pet?Yes, many providers offer plans for older pets, though premiums may be higher. It's important to compare options to find suitable coverage. https://www.aaha.org/resources/pet-insurance/how-do-i-choose-the-right-pet-insurance/

Note: Be sure to compare coverage options against your pet's breed-specific health risks. Some plans lack coverage for hereditary issues ... https://www.akcpetinsurance.com/plans/compare-coverage

AKC Pet Insurance Leads the Pack. Pet insurance is an investment in your dog or cat's health and future, so choose the right provider for your pet's unique ... https://www.petinsurance.com/comparison/fetch/

America's favorite pet insurer and #1 choice for pet parents for more than four decades - Pet insurance premiums starting at $13/mo.* - Visit any licensed ...

|